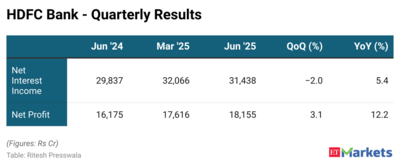

HDFC Bank on Saturday reported a 12% year-on-year growth in its Q1FY26 standalone net profit at Rs 18,155 crore versus Rs 16,175 crore in the year-ago period.

India's largest private lender earned an interest income of Rs 77,470 crore, which was up 6% from Rs 73,033 crore reported in the corresponding quarter of the last financial year.

HDFC Bank's net interest income (NII) for the quarter ended June 30, 2025 grew by 5.4% to Rs 31,440 crore from Rs 29,840 crore for the quarter ended June 30, 2024. Core net interest margin was reported at 3.35% on total assets, reflecting assets repricing faster than deposits, as against 3.46% for the prior quarter ended March 31, 2025.

HDFC Bank Bonus Share Announced

The lender announced issuance of first-ever bonus shares in the proportion of 1:1 which means one equity share for every 1 fully paid-up equity share each held by the members of the bank as on the record date of August 27.

HDFC Bank Declares Special Dividend

HDFC Bank also announced a special interim dividend of Rs 5 per equity share for FY 2025-26. The record date for the Special Interim Dividend has been set on July 25, 2025. The Special Interim Divided shall be paid to the eligible members on Monday, August 11, 2025.

HDFC Bank paid interest worth Rs 46,032.23 crore in the quarter under review versus Rs 43,196 crore in the year ago period which was an uptick of 6.6%.

Bank's operating expenses for the quarter under review was reported at Rs 17,430 crore as against Rs 16,620 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter, excluding the transaction gains mentioned above was at 39.6%.

Provisions and contingencies for the quarter stood at Rs 14,440 crore which includes the floating provisions of Rs 9,000 crore and additional contingent provisions of Rs 1,700 crore as against Rs 2,600 crore for the quarter ended June 30, 2024.

Balance Sheet

Total balance sheet size as of June 30, 2025 was Rs 39,54,100 crore as against Rs 35,67,200 crore as of June 30, 2024.

The Bank's average deposits were reported at Rs 26,57,600 crore for the June 2025 quarter, a growth of 16.4% over Rs 22,83,100 crore for the June 2024 quarter, and 5.1 % over Rs 25,28,000 crore for the March 2025 quarter.

Gross advances were reported at Rs 26,53,200 crore as of June 30, 2025, an increase of 6.7% over June 30, 2024. Advances under management grew by 8% over June 30, 2024.

Retail loans grew by 8.1%, small and mid-market enterprises loans grew by 17.1% and corporate and other wholesale loans grew by 1.7%. Overseas advances constituted 1.7% of total advances.

Asset Quality

Gross non-performing assets (GNPA) were at 1.40% of gross advances as on June 30, 2025 (1.14% excluding NPAs in the agricultural segment), as against 1.33% as on March 31, 2025, and 1.33% as on June 30, 2024. Net non-performing assets were at 0.47% of net advances as on June 30, 2025.

Network

As of June 30, 2025, the Bank's distribution network·was at 9,499 branches and 21,251 ATMs across 4,153 cities/towns as against 8,851 branches and 21,163 ATMs across 4,081 cities/towns as of June 30, 2024. 51 % of the branches are in semi-urban and rural areas.

India's largest private lender earned an interest income of Rs 77,470 crore, which was up 6% from Rs 73,033 crore reported in the corresponding quarter of the last financial year.

HDFC Bank's net interest income (NII) for the quarter ended June 30, 2025 grew by 5.4% to Rs 31,440 crore from Rs 29,840 crore for the quarter ended June 30, 2024. Core net interest margin was reported at 3.35% on total assets, reflecting assets repricing faster than deposits, as against 3.46% for the prior quarter ended March 31, 2025.

HDFC Bank Bonus Share Announced

The lender announced issuance of first-ever bonus shares in the proportion of 1:1 which means one equity share for every 1 fully paid-up equity share each held by the members of the bank as on the record date of August 27.

HDFC Bank Declares Special Dividend

HDFC Bank also announced a special interim dividend of Rs 5 per equity share for FY 2025-26. The record date for the Special Interim Dividend has been set on July 25, 2025. The Special Interim Divided shall be paid to the eligible members on Monday, August 11, 2025.

HDFC Bank paid interest worth Rs 46,032.23 crore in the quarter under review versus Rs 43,196 crore in the year ago period which was an uptick of 6.6%.

Bank's operating expenses for the quarter under review was reported at Rs 17,430 crore as against Rs 16,620 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter, excluding the transaction gains mentioned above was at 39.6%.

Provisions and contingencies for the quarter stood at Rs 14,440 crore which includes the floating provisions of Rs 9,000 crore and additional contingent provisions of Rs 1,700 crore as against Rs 2,600 crore for the quarter ended June 30, 2024.

Balance Sheet

Total balance sheet size as of June 30, 2025 was Rs 39,54,100 crore as against Rs 35,67,200 crore as of June 30, 2024.

The Bank's average deposits were reported at Rs 26,57,600 crore for the June 2025 quarter, a growth of 16.4% over Rs 22,83,100 crore for the June 2024 quarter, and 5.1 % over Rs 25,28,000 crore for the March 2025 quarter.

Gross advances were reported at Rs 26,53,200 crore as of June 30, 2025, an increase of 6.7% over June 30, 2024. Advances under management grew by 8% over June 30, 2024.

Retail loans grew by 8.1%, small and mid-market enterprises loans grew by 17.1% and corporate and other wholesale loans grew by 1.7%. Overseas advances constituted 1.7% of total advances.

Asset Quality

Gross non-performing assets (GNPA) were at 1.40% of gross advances as on June 30, 2025 (1.14% excluding NPAs in the agricultural segment), as against 1.33% as on March 31, 2025, and 1.33% as on June 30, 2024. Net non-performing assets were at 0.47% of net advances as on June 30, 2025.

Network

As of June 30, 2025, the Bank's distribution network·was at 9,499 branches and 21,251 ATMs across 4,153 cities/towns as against 8,851 branches and 21,163 ATMs across 4,081 cities/towns as of June 30, 2024. 51 % of the branches are in semi-urban and rural areas.

You may also like

Two people found dead on the Gold Coast within 24 hours of each other

Doctor explains if cracking joints actually causes arthritis

SBI CBO 2025 Exam: Must-Know Guidelines Before You Appear – Avoid Disqualification

Young mum quoted £600 for basic gardening job gets surprise of life

BHU Internship 2025: Apply Now for Dr. Sarvepalli Radhakrishnan Internship – Earn ₹20,000 Monthly Stipend